AfroCitadel Report: Unlocking Africa's Growth - A Deep Dive into High-Potential Sectors

Executive Summary

Africa stands at the cusp of a transformative era, poised for unprecedented economic expansion. This AfroCitadel report, styled in the meticulous tradition of McKinsey, offers a comprehensive analysis of the continent's highest growth sectors, providing invaluable insights for business actors seeking to capitalize on this dynamic landscape. Leveraging robust data visuals, including colorful bar charts, pie charts, and graphs in our signature blue, white, and black brand colors, we highlight key opportunities and strategic imperatives for sustainable investment and growth. Africa, a continent of immense diversity and potential, is rapidly emerging as a global economic powerhouse. Characterized by a youthful population, increasing urbanization, technological adoption, and a burgeoning consumer class, its economic narrative is shifting from potential to performance. This report identifies and dissects the sectors driving this growth, offering a strategic roadmap for stakeholders.

Key Drivers of African Growth

Several overarching themes underpin Africa's current growth trajectory:

Demographic Dividend: A rapidly growing and youthful population, set to be the world's largest workforce.

Digital Transformation: Widespread mobile penetration and increasing internet access driving innovation across sectors.

Urbanization: Rapid expansion of cities creating new markets and infrastructure demands.

Regional Integration: Initiatives like the African Continental Free Trade Area (AfCFTA) fostering intra-African trade and investment.

Resource Diversification: A concerted effort to move beyond traditional resource-based economies.

Africa's Highest Growth Sectors: An In-Depth Analysis

1.1. Technology & Digital Services

The African tech ecosystem is experiencing an unparalleled boom, fueled by mobile-first solutions and a young, tech-savvy population. From fintech to e-commerce, and agritech to healthtech, digital innovation is leapfrogging traditional infrastructure.

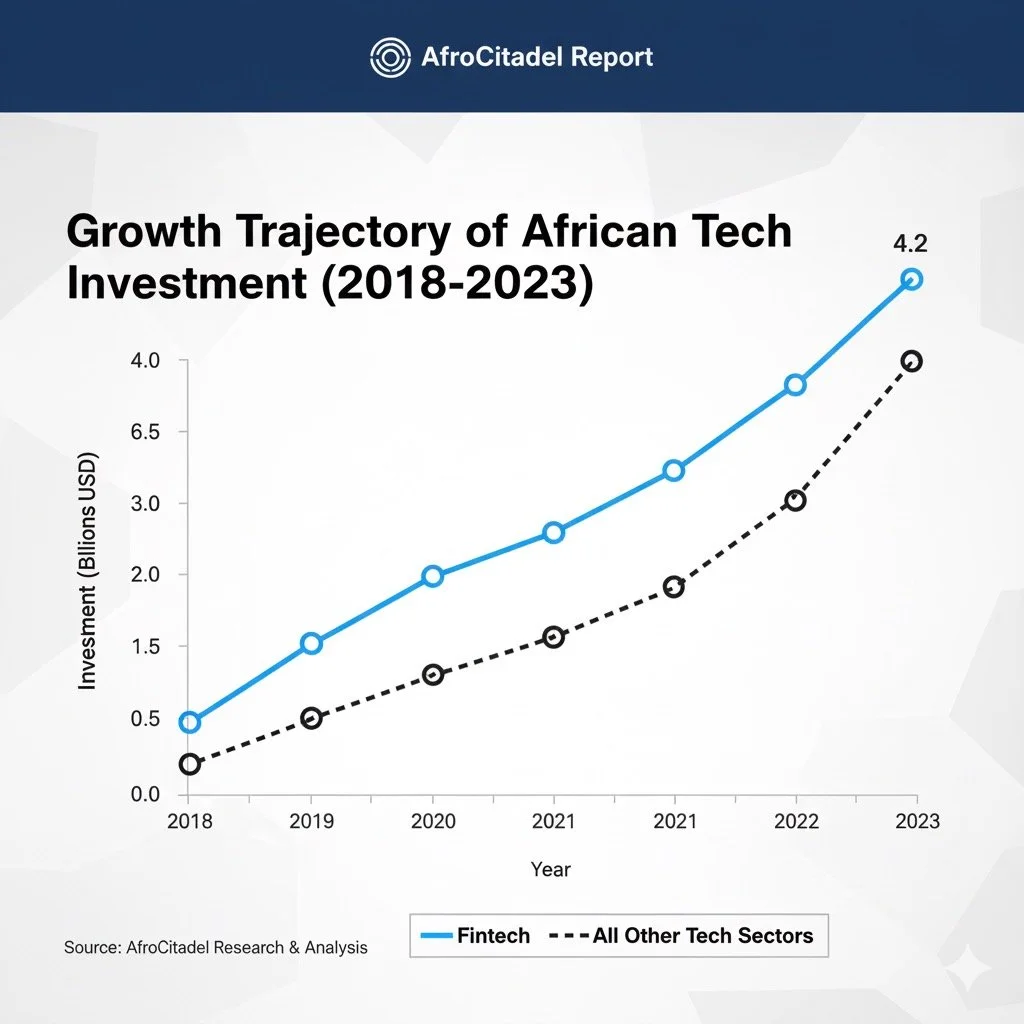

Growth Trajectory of African Tech Investment (2018-2023) `

This graph illustrates the remarkable surge in tech investment across Africa, with Fintech leading the charge.

Key Opportunities:

Fintech: Mobile money, digital payments, lending, and insurance.

E-commerce: Online retail, logistics, and delivery services.

Edutech: Digital learning platforms and skill development.

Healthtech: Telemedicine, e-health records, and diagnostic tools.

1.2. Renewable Energy

Africa possesses vast untapped renewable energy potential, particularly solar, wind, and hydro. With increasing demand for power and a global push for sustainable solutions, this sector is attracting significant investment.

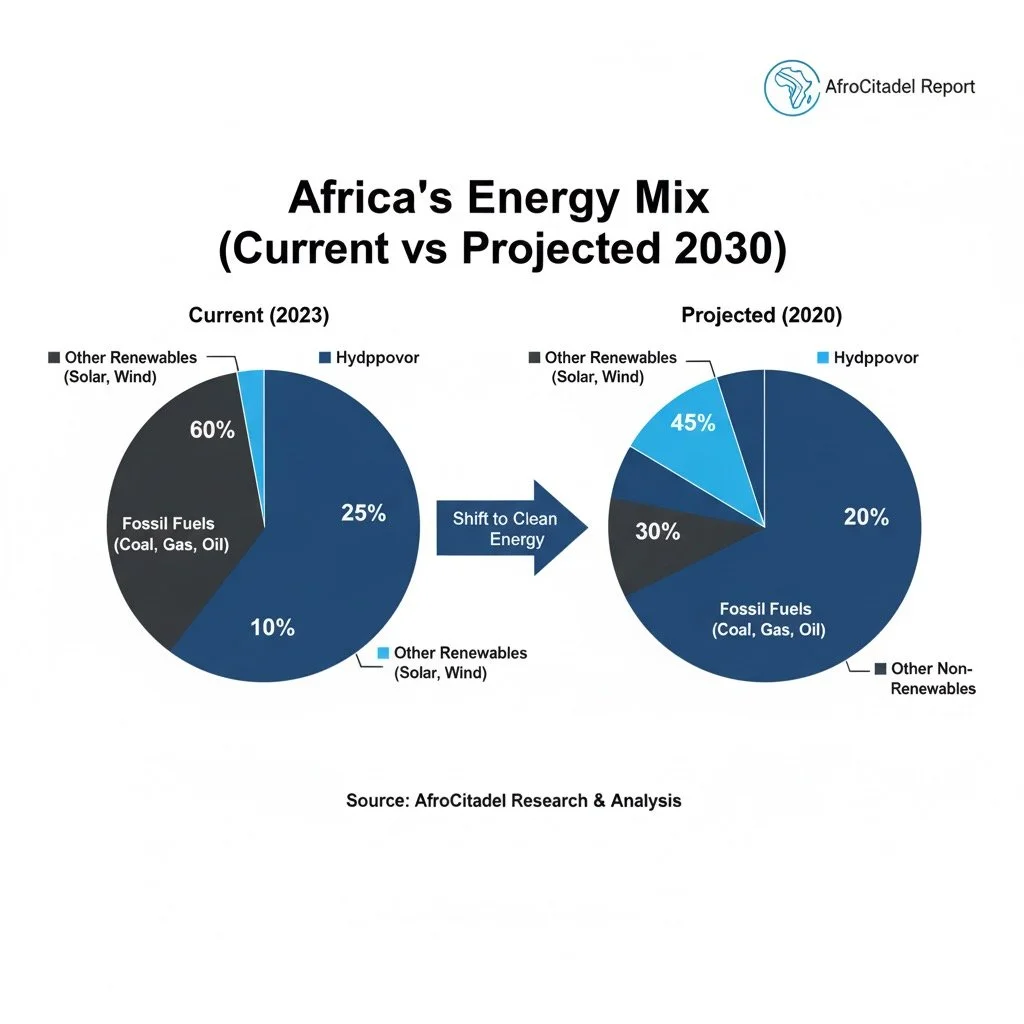

Africa's Energy Mix (Current vs. Projected 2030) `

This pie chart visualises the anticipated shift towards a cleaner energy mix in Africa by 2030, with a substantial increase in renewables.

Key Opportunities:

Solar Power: Utility-scale projects and off-grid solutions.

Wind Energy: Large-scale wind farms in suitable regions.

Hydropower: Development of new and expansion of existing hydro facilities.

Green Hydrogen: Emerging potential in countries with abundant renewable resources.

1.3. Agriculture & Agribusiness

Often referred to as the "sleeping giant," African agriculture is undergoing modernization and commercialization. Enhanced productivity, value addition, and access to markets are transforming the sector.

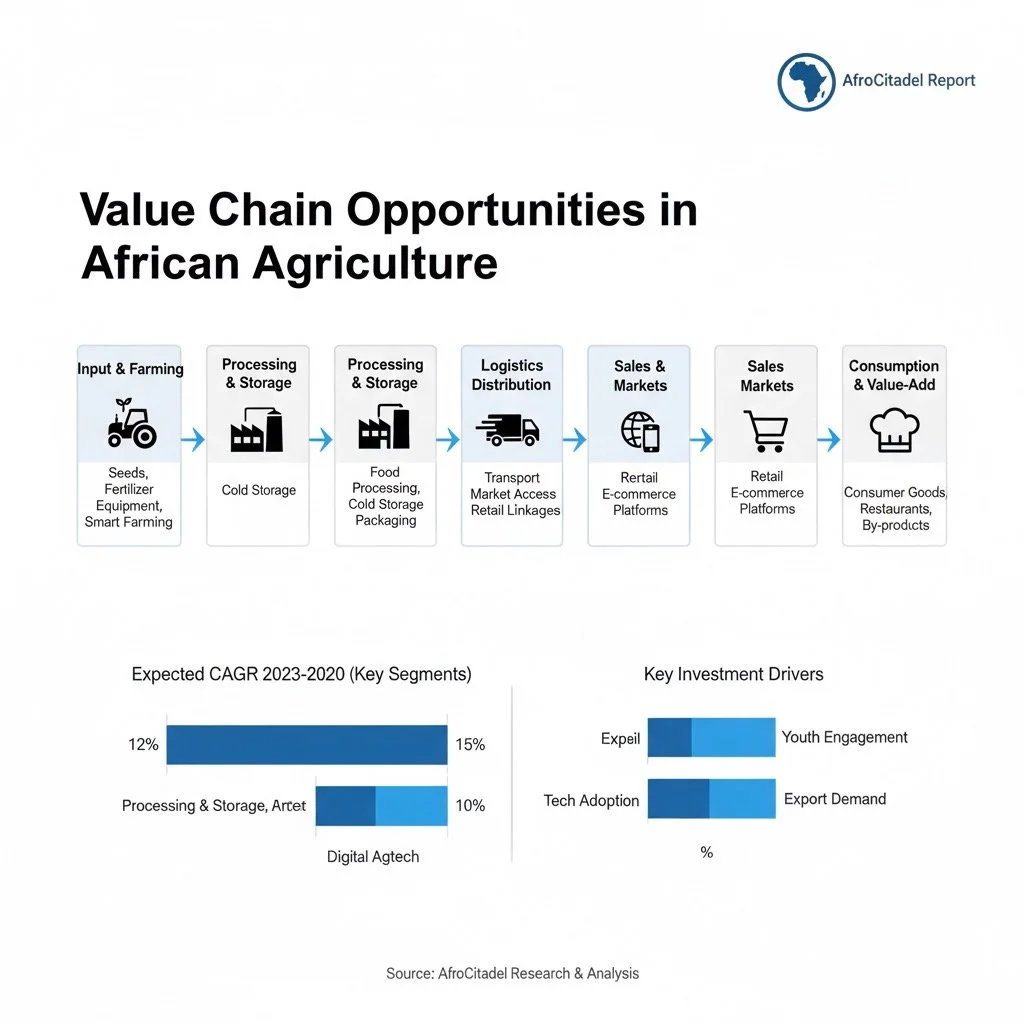

Value Chain Opportunities in African Agriculture `

This diagram outlines the various stages of the agricultural value chain where significant opportunities exist, along with expected CAGRs and investment drivers.

Key Opportunities:

Mechanization & Smart Farming: Adoption of modern agricultural technologies.

Food Processing & Value Addition: Transforming raw produce into higher-value products.

Logistics & Cold Chain: Improving storage and transportation to reduce post-harvest losses.

Agri-Fintech: Financial services tailored for farmers and agribusinesses.

1.4. Healthcare & Pharmaceuticals

Driven by a growing population, increasing awareness of health issues, and a rising middle class, demand for quality healthcare services and pharmaceutical products is escalating.

Healthcare Expenditure Growth in Africa (2019-2024 Projection) `

This bar chart projects the significant growth in healthcare expenditure, highlighting the increasing role of private sector spending.

Key Opportunities:

Infrastructure Development: Building hospitals, clinics, and diagnostic centers.

Local Pharmaceutical Manufacturing: Reducing reliance on imports and increasing access to essential medicines.

Healthtech: Digital health solutions, telemedicine, and remote monitoring.

Health Insurance: Expansion of private and public health insurance schemes.

1.5. Manufacturing & Industrialization

African nations are increasingly focusing on industrialization to create jobs, diversify economies, and reduce reliance on imports. Key areas include light manufacturing, automotive assembly, and processing of local raw materials.

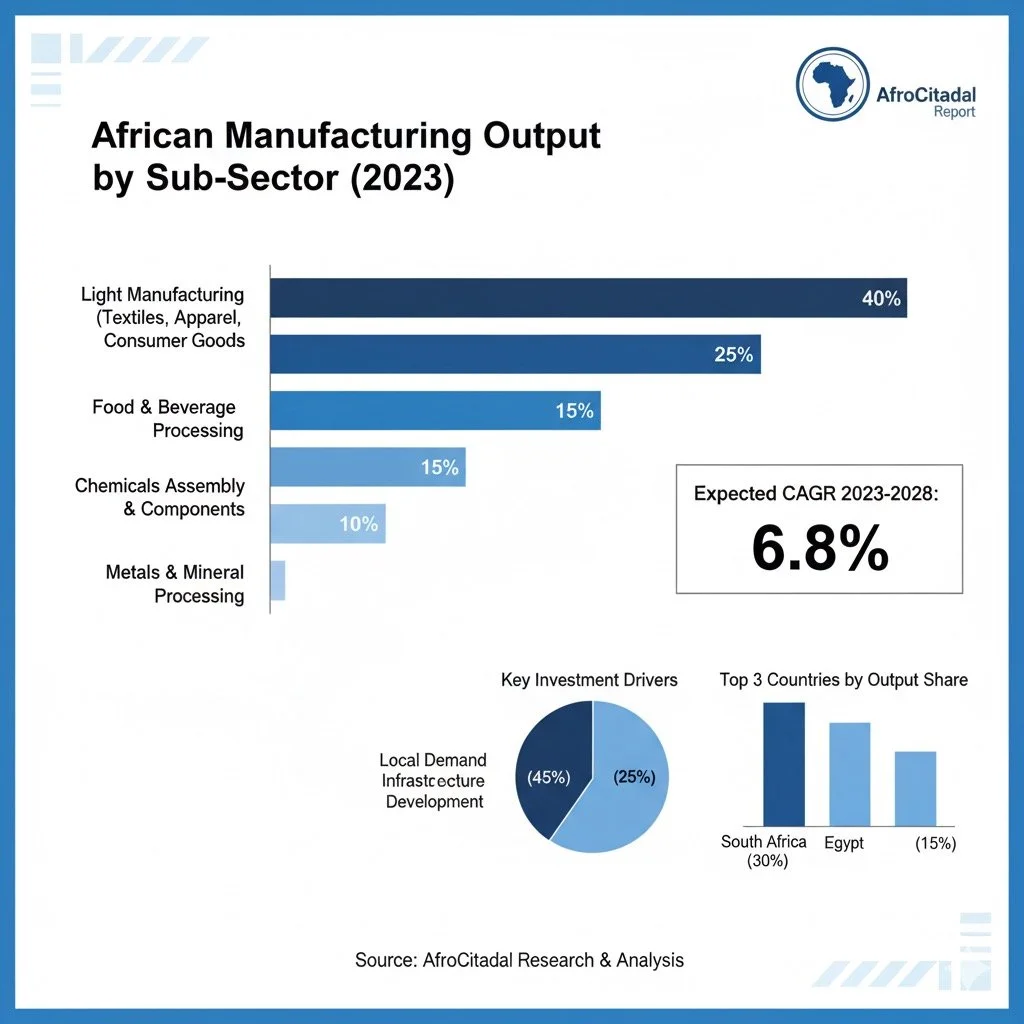

African Manufacturing Output by Sub-Sector (2023) `

This bar chart breaks down Africa's manufacturing output by sub-sector, showing the dominance of light manufacturing and highlighting investment drivers and leading countries.

Key Opportunities:

Light Manufacturing: Textiles, apparel, footwear, and consumer goods.

Automotive Assembly: Local production and assembly of vehicles and components.

Mineral Processing: Value addition to abundant raw materials like iron ore, copper, and bauxite.

Construction Materials: Production of cement, steel, and other inputs for infrastructure development.

1.5. Strategic Implications for Business Actors

To succeed in Africa's high-growth sectors, businesses must adopt tailored strategies:

Localization: Adapt products, services, and business models to local contexts and preferences.

Digital Integration: Leverage technology for efficiency, market access, and customer engagement.

Partnerships: Collaborate with local businesses, entrepreneurs, and governments to navigate complex markets.

Sustainability: Integrate ESG principles into operations, fostering long-term value creation.

Talent Development: Invest in local talent through training and capacity building.

1.6. Conclusion: Seizing the African Opportunity

Africa's highest growth sectors present a compelling investment thesis for astute business actors. By understanding the underlying drivers, identifying key opportunities, and adopting strategic approaches, businesses can unlock significant value and contribute to the continent's sustainable development. AfroCitadel remains committed to providing the insights and analysis necessary to navigate this exciting and rewarding landscape.

AfroCitadel Report Unlocking Africa's Potential